Our trip to Riverdale raised a bunch of questions for Lyle and I regarding what we can afford. In the world of home ownership, it can be extremely difficult to predict the universe of potential expenses vs. the money you can expect to get back with tax deductions. When it comes to a single family house, it's relatively basic. You buy a house, you have a mortgage. With a condominium or co-op it can get a little more complicated when you consider high monthly maintenance fees. But how much can we really afford? What's considered tax deductible and what isn't? Walking around the Costco, I consulted my Mom and brother, both accountants, one thirty years and one for three, to get answers.

The basic breakdown is this, if you itemize your tax return you can deduct the interest you pay on your mortgage and the annual taxes you need to pay on the property. Those are the two heavy hitters. There are also a number of other tax breaks available when owning a home, although it is important to keep in mind the difference between tax deductions and tax credits. What I didn't realize was that you could adjust your withholding with your employer to increase your take home pay throughout the year, post home purchase. You don't need to wait until filing time to see some of that savings.

As for those monthly maintenance fees Lyle and I heard of on our Riverdale walkabout, the percentage of what's tax deductible is only based on a portion of the maintenance that is used to pay real estate taxes and interest on the building's underlying mortgage. The common charges that go to upkeep of the building and many other things like liability insurance, snow removal, doorman, etc. are not.

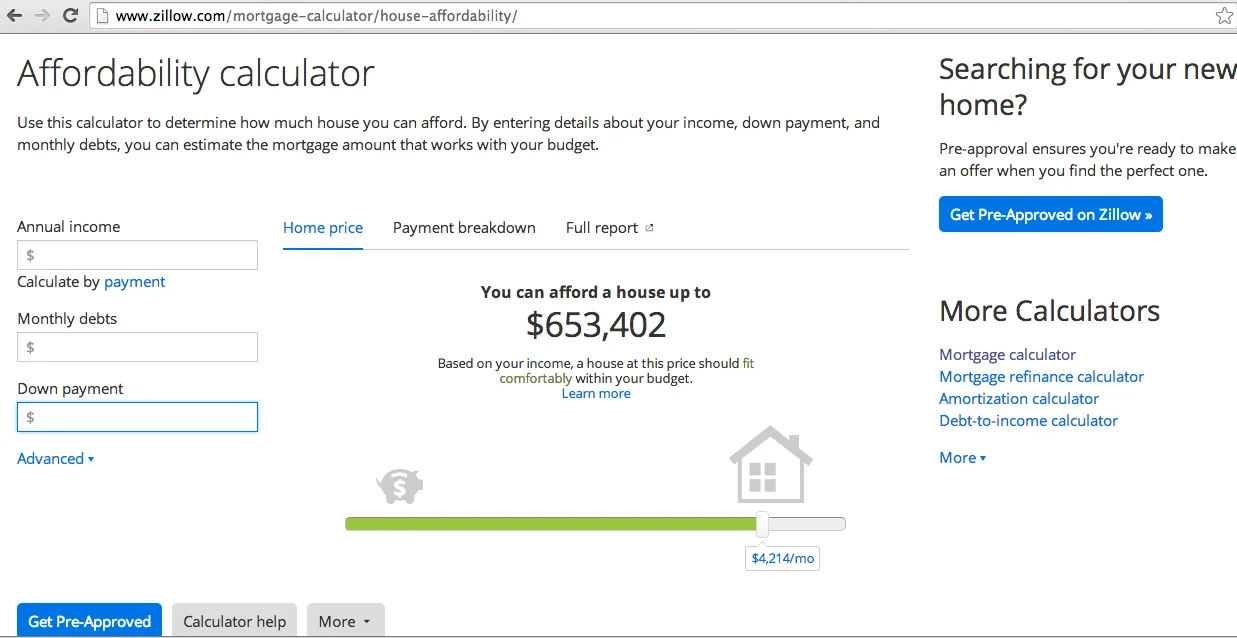

So the question remains, how much house can Lyle and I afford? I consulted a couple of web-based fortune-tellers. Zillow's Affordability Calculator said $650,000, which seems wow! unbelievably high. This simple calculator didn't take into consideration location, potential property taxes, etc. The word 'affordability' should be nowhere on the page. $650,000 is out of the question.

Trulia's 'How much home can I afford' calculator put us at $500,000, although I definitely took a shot-in-the-dark guess at potential property taxes and homeowner's insurance.

The NYTimes offers an interactive 'Is it better to rent or buy' calculator, which I thiiiiink told me it would be better for us to buy, although I'm not sure I had enough reliable data to have a true output.

So I decided I needed some clairvoyance. On Sunday, my mom, brother, aunt, grandmother and I, went to the Art Association of Harrisburg to attend a gallery reading of William Stillman, psychic and spiritual counselor. According to Bill, we did make contact with my grandfather, who has passed, but unfortunately Poppop didn't have anything pressing to communicate about my future home ownership. Zero predictions on what we'll be comfortable spending. I guess Lyle and I will have to do it the old fashioned way and call up a real professional, a mortgage lender.