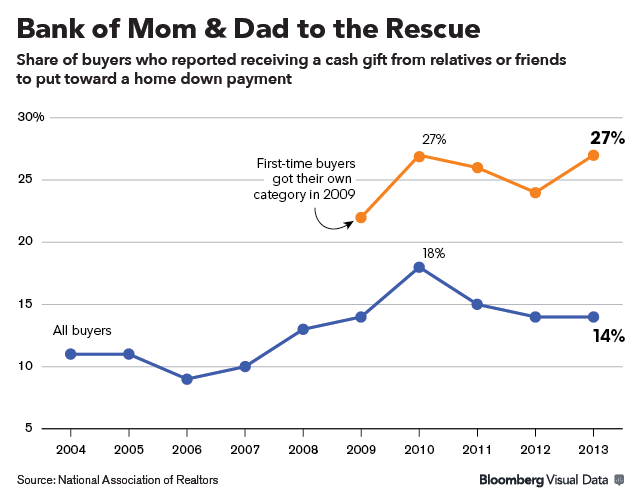

On Friday, Bloomberg.com published an article noting that the hot lending institution for first time home buyers is none other than good ol' Mom and Dad. The percentage of newbies to the housing market that received cash gifts from relatives for their down payment continues to rise, to a significant 27% in fact.

The author, Michelle Jamrisko, contributes this growing number of gift acceptors to "student debt, tough entry into the job market and stricter mortgage lending rules." I fear that circumstance is playing a critical role in the obsolescence of independence. Why would anyone work to save, when cash can just magically appear? (to the tune of $14,000 per parent without tax repercussions)

The Federal Reserve's 2013 report on the economic wellbeing of households noted the "inability to come up with a down payment as the top reason for renting." Sounds to me like the 73% of us who don't have the ability, or frankly the desire, to ask for money from our families are stuck on the rental wagon.

The really sad part of all this is that it's a recipe for furthering the economic divide. As the "haves" accumulate real estate equity built upon their parents' wealth, the "have nots" will be continuing to throw rental money into the ether. And what happens to our children who will be born to a generation that didn't have to fend for themselves?

I suppose the honest question here is Where'sMy.DownPayment???