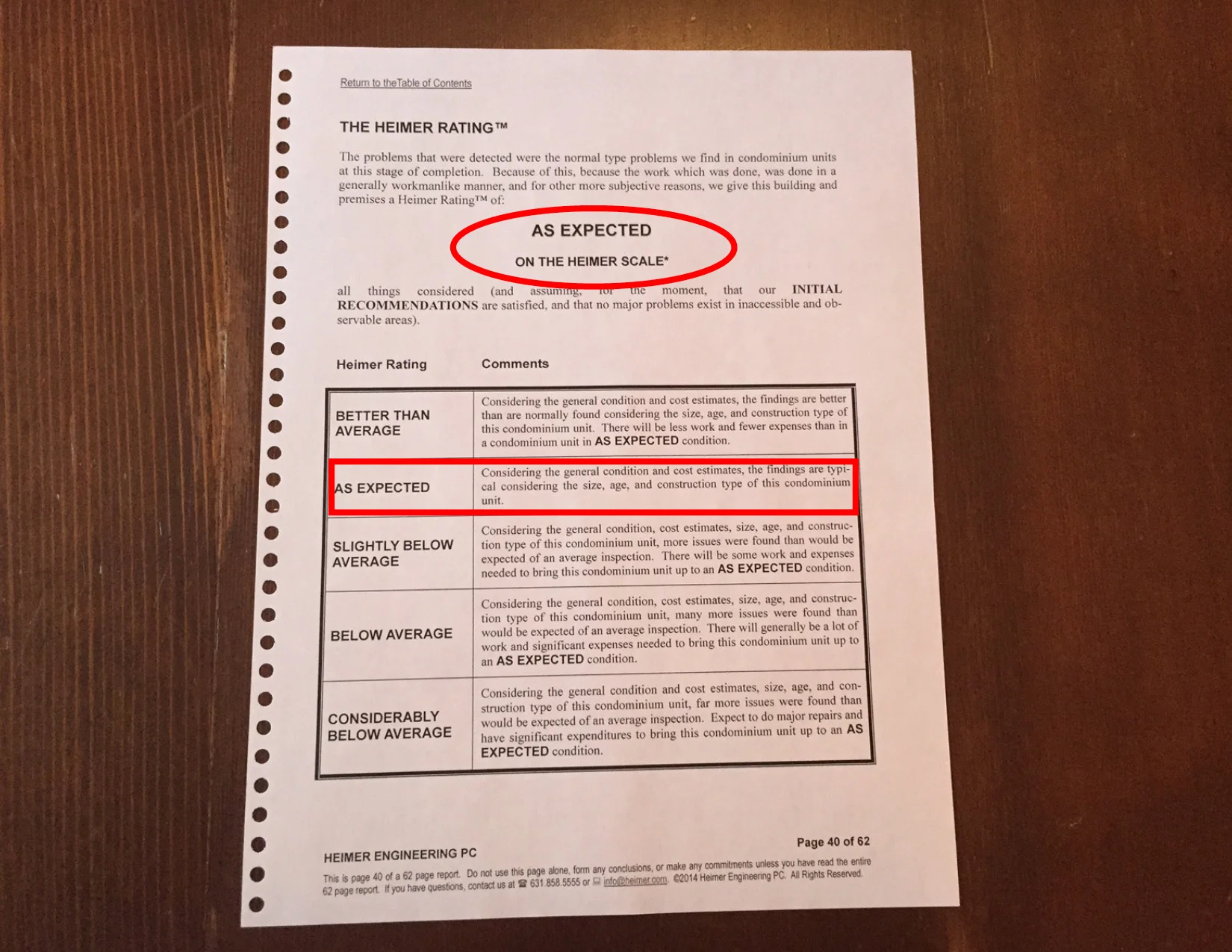

Each day we're one step closer to signing a contract! We got our engineering report back this week, and although there are a few things that need to be addressed (a broken window lock, replacement of a regular outlet with a GFCI outlet, etc.), its looks like the place is approved for move-in.

We met with our attorney on Monday, where we reviewed the entire offering plan and gathered commentary.

The current decision Lyle and I have to make is whether we make our contract contingent upon FHA loan approval. Since this is a new development, the property has not previously filed for FHA approval. According to our lawyer, condo developers tend to shy away from getting approval because its a ton of paperwork and time. In fact, in speaking with another lender, we realized that less than 100 condominium developments in all of Queens County are actually FHA approved. Should we include this contingency, we could risk the contract being null and loosing the place if approval isn't obtained.

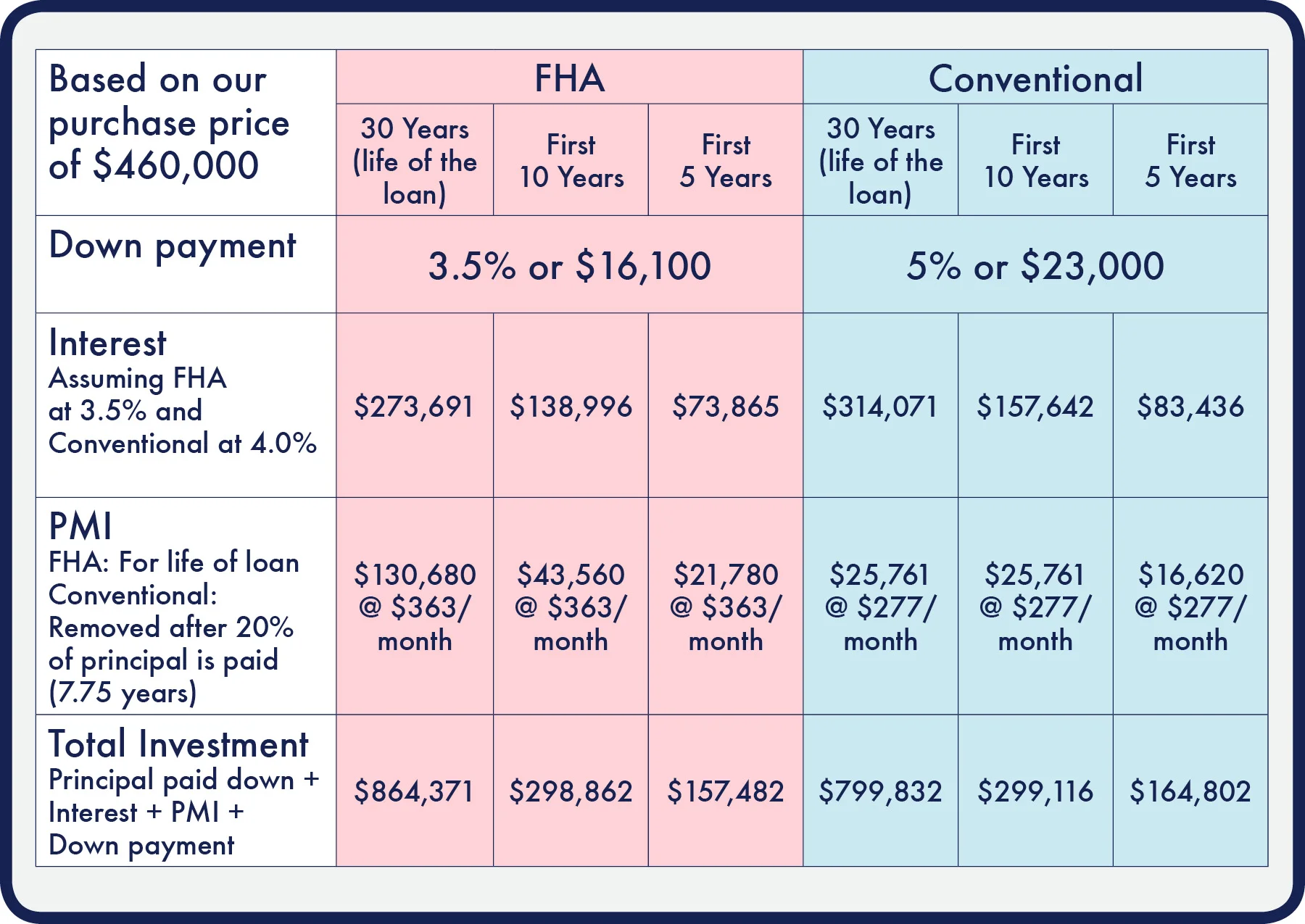

FHA loan or conventional loan, our monthly payment won't look much different. The longer we would hold onto the home the more attractive a conventional loan becomes. We did some back-of-the-envelope calculations, using interest rate schedules and PMI estimates from Zillow. These numbers are by no means exact, but rather give a broad idea of where these loans differ.

Outside of the loan contingency, there are oodles of points in the contract to negotiate. The two attorneys, ours and the seller's, have officially begun the dance.